38 treasury bills coupon rate

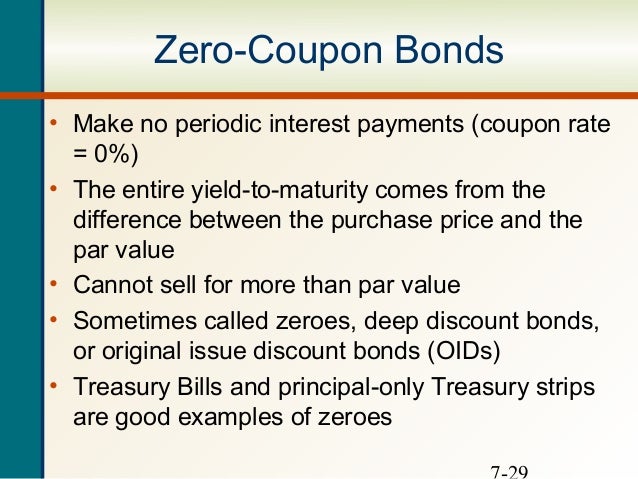

Treasury Bills vs Bonds | Top 5 Differences (with Infographics) T-bills do not pay any coupon. They are floated as a zero-coupon bond to the investors, they are issued at discounts, and the investors receive the face value at the end of the tenure, which is the return on their investment. Bonds pay interest in the form of a coupon to the investors quarterly or semi-annually. T-bills have no default risk US Treasury Bonds - Fidelity US Treasury bills: $1,000: Discount: 4-, 8-, 13-, 26-, and 52-week: Interest and principal paid at maturity: US Treasury notes: $1,000: Coupon: 2-, 3-, 5-, 7-, and 10-year: Interest paid semi-annually, principal at maturity: US Treasury bonds: $1,000: Coupon: 30-year: Interest paid semi-annually, principal at maturity: Treasury inflation-protected securities (TIPS) $1,000: Coupon

Bonds & Bills - Monetary Authority of Singapore Interest Rates of Banks and Finance Companies ... Discover Singapore Government Securities (SGS) bonds, Treasury bills (T-bills), MAS Bills, MAS FRN and Singapore Savings Bonds (SSB). Benefits. Fully backed by the Government ... Tradable government debt securities that pay a fixed coupon every 6 months. SGS bonds comprise SGS (Market ...

Treasury bills coupon rate

Interest Rate Statistics | U.S. Department of the Treasury Daily Treasury Bill Rates These rates are indicative closing market bid quotations on the most recently auctioned Treasury Bills in the over-the-counter market as obtained by the Federal Reserve Bank of New York at approximately 3:30 PM each business day. View the Daily Treasury Bill Rates Daily Treasury Long-Term Rates and Extrapolation Factors Treasury Bonds Rates - WealthTrust Securities Limited A Treasury Bond (T-Bond) is a zero default-risk, extremely liquid medium to long term debt instrument issued by the CBSL which consists of maturity period ranging from 2 to 25 years with semiannual coupon payments. Unlike a T-Bill, the holder of a T-Bond will be entitled to semi-annual periodic interest payments (coupon interest) which are paid ... Reserve Bank of India Coupon on this security will be paid half-yearly at 4.12% (half yearly payment being half of the annual coupon of 8.24%) of the face value on October 22 and April 22 of each year. ii) Floating Rate Bonds (FRB) - FRBs are securities which do not have a fixed coupon rate.

Treasury bills coupon rate. Treasury Bills (T-Bills) Definition - Investopedia As stated earlier, the Treasury Department auctions new T-bills throughout the year. On March 28, 2019, the Treasury issued a 52-week T-bill at a discounted price of $97.613778 to a $100 face... Investors expect higher rate as CBN pays maturing treasury bills ... Ahead of payment of maturing treasury bills worth N167.2 billion on Wednesday by the Central Bank of Nigeria (CBN), investors are expecting a higher stop rate for the various tenor buckets.. For the long term (364-day) tenor instrument, investors anticipate 7.0 percent interest rate, which is 0.51percentage point higher than 6.49 percent stop rate offered by the CBN on the previous auction ... Treasury Bills - Types, Features and Advantages of Government ... - Groww Yield Rate on Treasury Bills The percentage of yield generated from a treasury bill can be calculated through the following formula - Y = (100-P)/P x 365/D x 100 Where Y = Return per cent P = Discounted price at which a security is purchased, and D = Tenure of a bill Let us consider a treasury bills example for better understanding. 91 Day T Bill Treasury Rate - Bankrate Year ago. 91-day T-bill auction avg disc rate. 0.90. 0.86. 0.02. What it means: The U.S. government issues short-term debt at a discount at a competitive auction, usually on a weekly basis. At a ...

How Are Treasury Bill Interest Rates Determined? - Investopedia For example, suppose an investor purchases a 52-week T-bill with a face value of $1,000. The investor paid $975 upfront. The discount spread is $25. After the investor receives the $1,000 at the... Individual - Treasury Bonds: Rates & Terms Treasury Bonds: Rates & Terms Treasury bonds are issued in terms of 20 years and 30 years and are offered in multiples of $100. Price and Interest The price and interest rate of a bond are determined at auction. The price may be greater than, less than, or equal to the bond's par amount (or face value). (See rates in recent auctions .) Treasury Coupon Issues | U.S. Department of the Treasury TNC Treasury Yield Curve Spot Rates, Monthly Average: 1976-1977 TNC Treasury Yield Curve Spot Rates, Monthly Average: 1978-1982 TNC Treasury Yield Curve Spot Rates, Monthly Average: 1983-1987 TNC Treasury Yield Curve Spot Rates, Monthly Average: 1988-1992 TNC Treasury Yield Curve Spot Rates, Monthly Average: 1993-1997 Treasury Bills (T-Bills) - Meaning, Examples, Calculations For example, The US Federal Treasury Department issued 52week T-Bills at a discounted rate of $97 per bill at face value of $100. An investor purchases 10 T-Bills at a competitive bid price of $97 per bill and invests a total of $970. After 52 weeks, the T bills matured.

Understanding Treasury Bond Interest Rates | Bankrate Imagine a 30-year U.S. Treasury Bond is paying around a 1.25 percent coupon rate. That means the bond will pay $12.50 per year for every $1,000 in face value (par value) that you own. The ... Central Bank of Nigeria:: Government Securities Date of Auction: 4/25/2022: 4/25/2022: 3/21/2022: 3/21/2022: Security Type: FGN BOND: FGN BOND: FGN BOND: FGN BOND: Tenor Maturity Date: 10 YEAR 3/23/2025 3/23/2025 Treasury Bills - Guide to Understanding How T-Bills Work In this case, the discount rate is 5% of the face value. Get T-Bill rates directly from the US Treasury website. How to Purchase Treasury Bills Treasury bills can be purchased in the following three ways: 1. Non-competitive bid In a non-competitive bid, the investor agrees to accept the discount rate determined at auction. Ορισμός ομολογίας - upatras eclass που εκδίδονται από το δημόσιο (government bonds) και επιχειρήσεις. (corporate bonds) και έχουν ... Ομόλογα με σταθερό (περιοδικό) τοκομερίδιο (coupon bond).60 σελίδες

Selected Treasury Bill Yields - Bank of Canada Selected Treasury Bill Yields. View or download the latest data for treasury bill yields, treasury bill auctions, and treasury bills. Look up the past ten years of data for these series. Access selected data on bond yields.

US Treasury Bonds Rates - Yahoo Finance US Treasury Bonds Rates. Symbol. Name Last Price Change % Change 52 Week Range Day Chart ^IRX. 13 Week Treasury Bill: 1.1350 +0.0220 +1.98% ^FVX. Treasury Yield 5 Years: 2.9510 +0.0420 +1.44% ^TNX ...

United States Rates & Bonds - Bloomberg 6/3/2022. GB12:GOV. 12 Month. 0.00. 2.07. 2.13%. +13. +210. 6/3/2022.

Individual - Treasury Bills In Depth Treasury Bills In Depth Treasury bills, or T-bills, are typically issued at a discount from the par amount (also called face value). For example, if you buy a $1,000 bill at a price per $100 of $99.986111, then you would pay $999.86 ($1,000 x .99986111 = $999.86111).* When the bill matures, you would be paid its face value, $1,000.

Treasury Bond (T-Bond) - Overview, Mechanics, Example A Treasury bond (or T-Bond) is a long-term government debt security issued by the U.S. Treasury Department with a fixed rate of return. Maturity periods range from 20 to 30 years. T-bond holders receive semi-annual interest payments (called coupons) from inception until maturity, at which point the face value of the bond is also repaid.

Post a Comment for "38 treasury bills coupon rate"