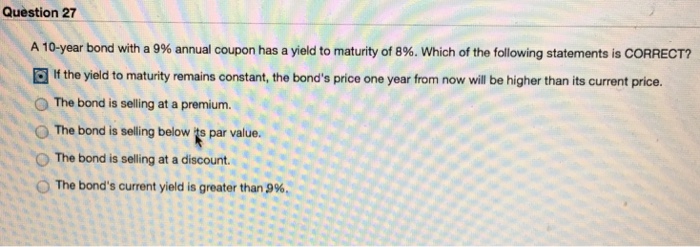

40 a 10 year bond with a 9 annual coupon

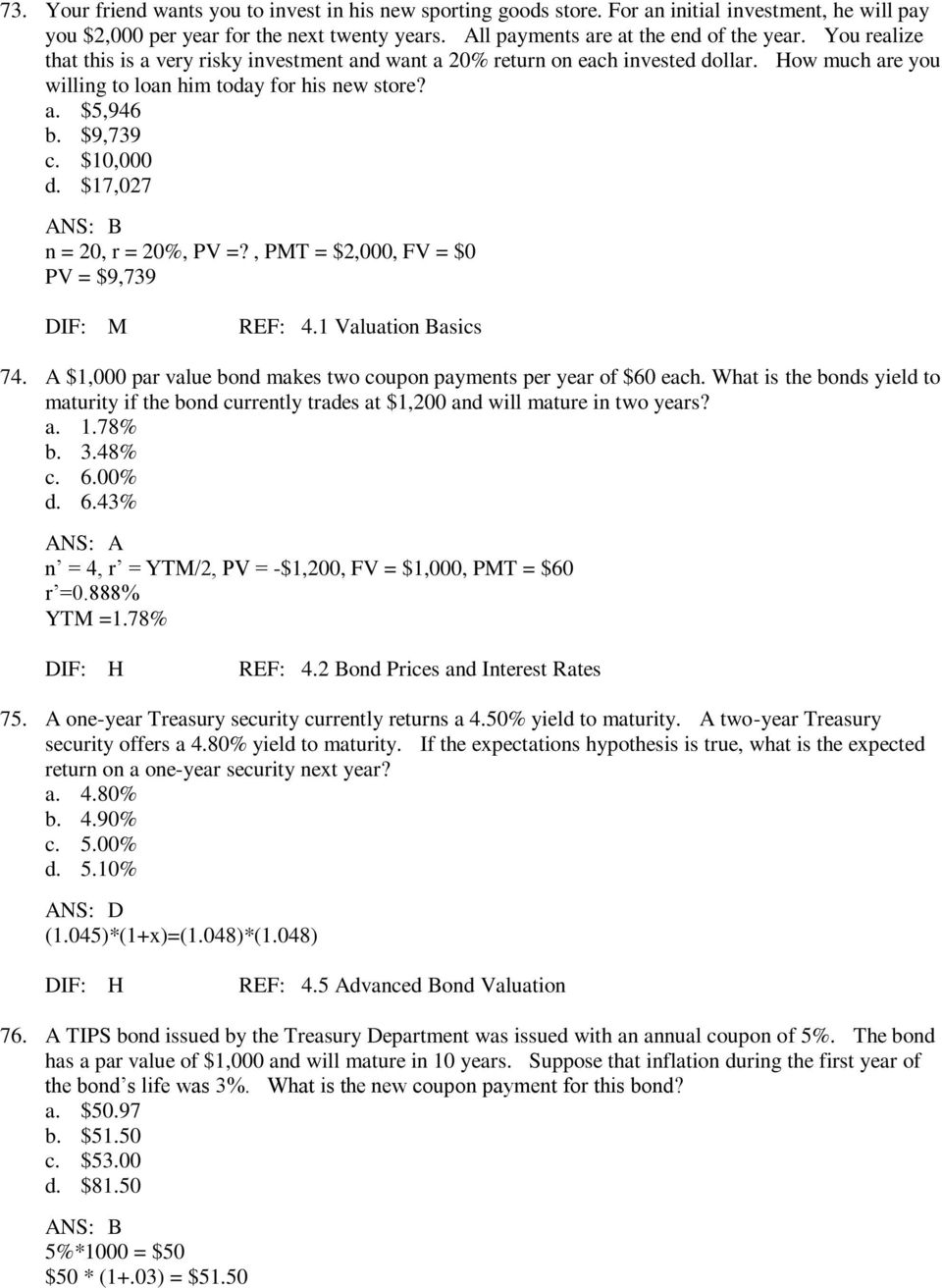

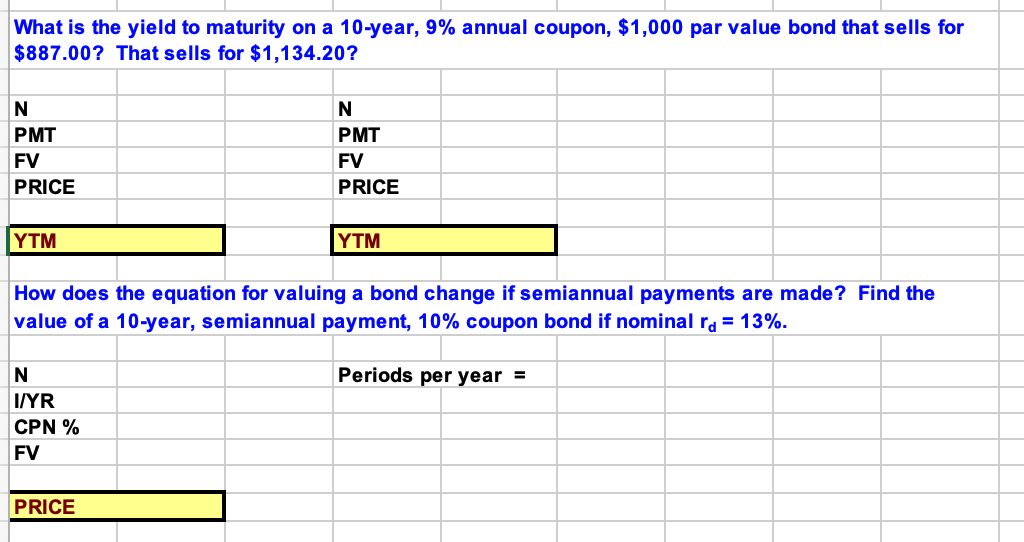

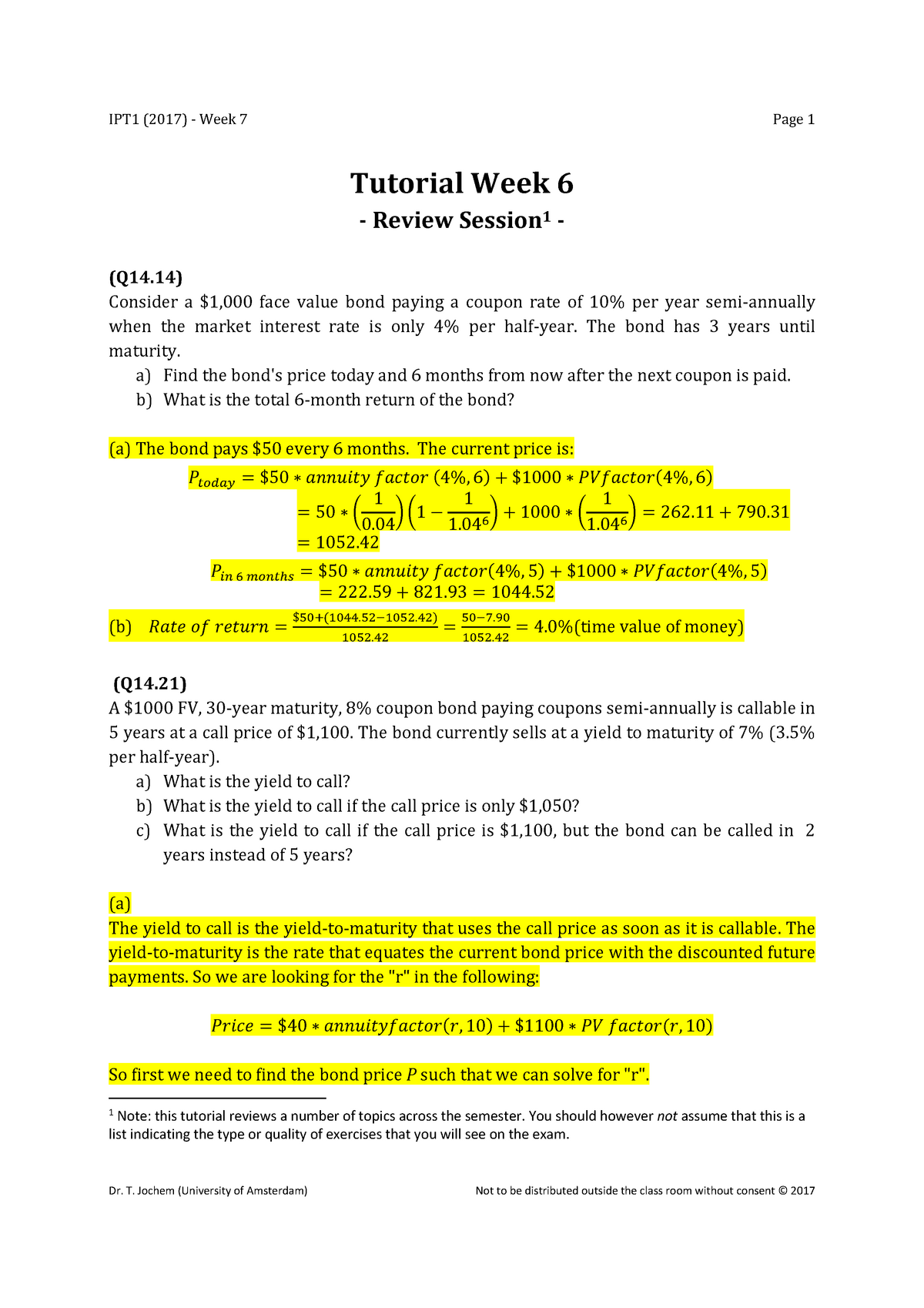

63 a 12 year bond has a 9 percent annual coupon a A bond with 10 years to maturity has a face value of $1,000. The bond pays an 8 percent semiannual coupon, and the bond has a 9 percent nominal yield to maturity. What is the price of the bond today? a. $908.71 b. $934.96 c. $935.82 d. $952.37 e. $960.44 Bond value--semiannual payment Answer: Diff: E Bond Price Calculator | Formula | Chart The n for Bond A is 10 years. Determine the yield to maturity (YTM). The YTM is the annual rate of return that the bond investor will get if they hold the bond from now to when it matures. In this example, YTM = 8%. Calculate the bond price

FINC 301 Chapter 8 problems (Exam 2) Flashcards | Quizlet 7.08. An investor buys a 30-year bond with a $1,000 face value for $800. The bond's coupon rate is 8% and interest payments are made semi-annually. What is the bond's yield to maturity? periodic: 5.07. annual: .1014. A 10-year, 8% annual coupon bond selling for $1,135.90 has been called after 4 years for $1,080.

A 10 year bond with a 9 annual coupon

Bond: Financial Meaning With Examples and How They Are Priced Jul 01, 2022 · Bond: A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or ... Bond Valuation Calculator | Calculate Bond Valuation Bond Valuation Definition. Our free online Bond Valuation Calculator makes it easy to calculate the market value of a bond. To use our free Bond Valuation Calculator just enter in the bond face value, months until the bonds maturity date, the bond coupon rate percentage, the current market rate percentage (discount rate), and then press the calculate button. Bond Pricing Formula | How to Calculate Bond Price? | Examples Since the coupon rate is higher than the YTM, the bond price is higher than the face value, and as such, the bond is said to be traded at a premium. Example #3. Let us take the example of a zero-coupon bond. Let us assume a company QPR Ltd has issued a zero-coupon bond with having a face value of $100,000 and maturing in 4 years.

A 10 year bond with a 9 annual coupon. 3. A 10-year corporate bond has an annual coupon of 9%. The… - JustAnswer I have a question: A 20-year, $1,000 par value bond has a 9% annual coupon. The bond currently sells for $925. If the yield to maturity remains at its current rate, what will the price be 5 years from … read more SPAB: SPDR® Portfolio Aggregate Bond ETF - SSGA The Bloomberg U.S. Aggregate Bond Index (the "Index") is designed to measure the performance of the U.S. dollar denominated investment grade bond market, which includes investment grade (must be Baa3/BBB- or higher using the middle rating of Moody's Investors Service, Inc., Standard & Poor's Financial Services, LLC, and Fitch Inc.) government bonds, investment grade corporate bonds, mortgage ... A 10 year bond has a 10 percent annual coupon and a The annual bond is also 10% translating a greater value of the current yield, hence, the current yield is greater than 10 percent for the years of the bond. 7. A 12-year bond has a 9 percent annual coupon, a yield to maturity of8 percent, and a face value of $1,000. What is the price of the bond?a. $1,469b. $1,000c. $ 928d. $1,075e. $1,957 d. iShares 0-5 Year TIPS Bond ETF | STIP - BlackRock Sep 15, 2022 · The iShares 0-5 Year TIPS Bond ETF seeks to track the investment results of an index composed of inflation-protected U.S. Treasury bonds with remaining maturities of less than five years.

Buying a $1,000 Bond With a Coupon of 10% - Investopedia These bonds typically pay out a semi-annual coupon. Owning a 10% ten-year bond with a face value of $1,000 would yield an additional $1,000 in total interest through to maturity. If interest rates ... A 10-year bond with a 9% annual coupon has a yield to...ask 5 - Quesba A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. the bond is selling below its par value. b. the bond is selling at a discount. c. the bond will earn a rate of return greater than 8%. d. the bond is selling at a premium to par value FINN 3226 CH. 4 Flashcards | Quizlet A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. b. Question 12 a 10 year bond with a 9 annual coupon has Question 12 A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? Selected Answer: If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price.

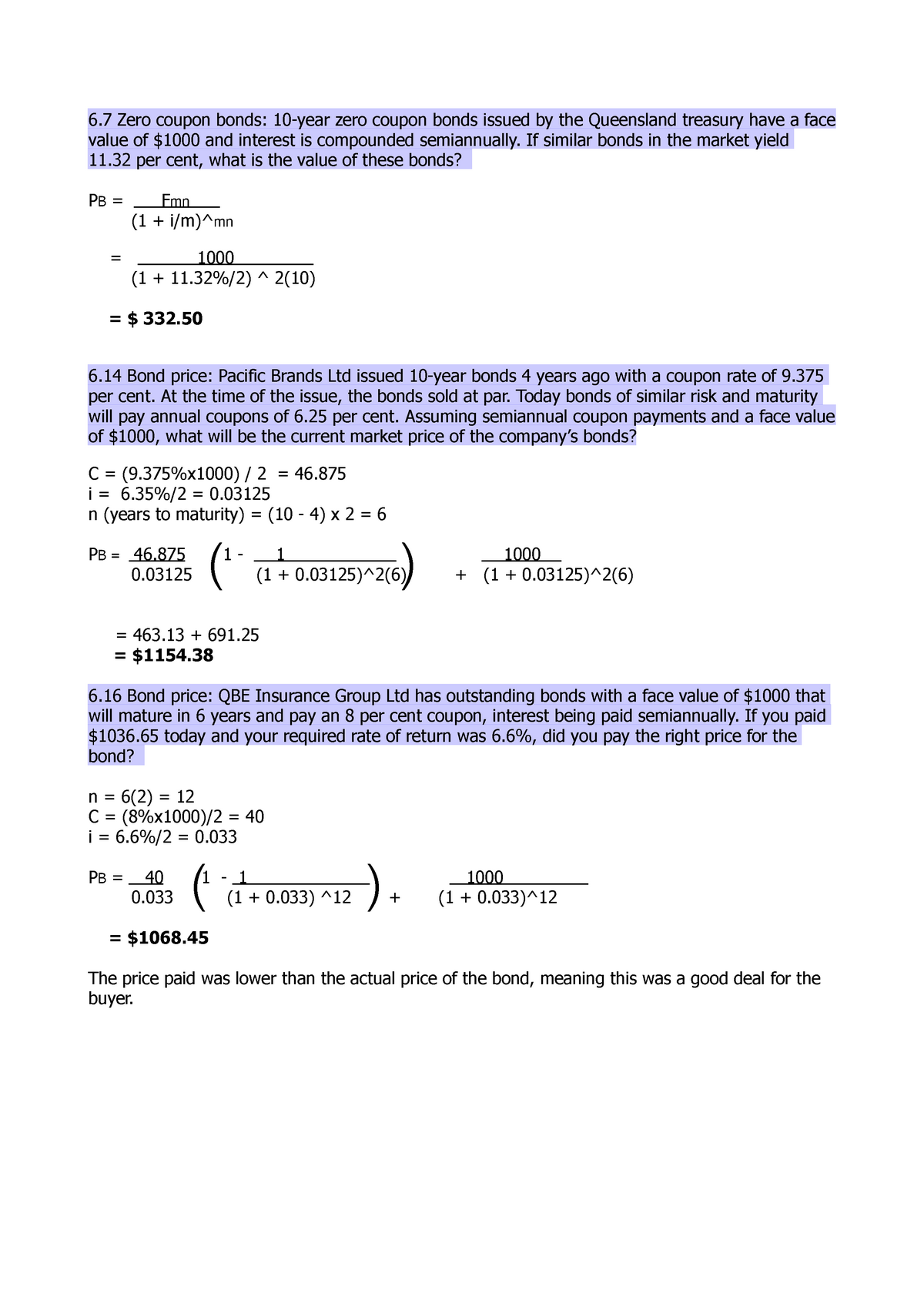

A 10-year bond with a 9% annual coupon has a yield to maturity… I have a question: A 20-year, $1,000 par value bond has a 9% annual coupon. The bond currently sells for $925. If the yield to maturity remains at its current rate, what will the price be 5 years from … read more Solved A 10-year bond with a par value of $1,000 has a 9% - Chegg A 10-year bond with a par value of $1,000 has a 9% annual coupon rate. The bond currently sells for $1,140.47. If the bond's yield to maturity remains at 7%, what will be the price of the bond 4 years from now? $1,067.74 Oa Ob Oc $1,494.92 $1,095.33 $1,000 d Question: A 10-year bond with a par value of $1,000 has a 9% annual coupon rate. Answered: A 9% semiannual coupon bond matures in… | bartleby Q: A bond has a $1,000 par value, 7 years to maturity, and a 9% annual coupon and sells for $1,095.… A: A bond is a financial security that is sold by large entities to borrow funds. Generally, it is… Answered: Assume a 10-year, $1,000 par value bond… | bartleby Solution for Assume a 10-year, $1,000 par value bond with a 10 percent annual coupon if its required rate of return is 10 percent what is the value of the bond?

Answered: 1. A 12-year bond has a 9 percent… | bartleby A 12-year bond has a 9 percent annual coupon, a yield to maturity of 8 percent, and a face value of P1,000. a. What is the current yield of the bond? b. What is the price of the bond? 2. An annual coupon bond with a P1,000 face value matures in 10 years. The bond currently sells for P903.7351 and has a 9 percent yield to maturity.

Chapter 6 -- Interest Rates - California State University ... Example: a 10-year bond carries a 6% coupon rate and pays interest semiannually. The market price of the bond is $910.00. The bond can be called after 5 years at a call price of $1,050. What should be YTC for the bond? YTC = 4.55%*2 = 9.10% (4) Current yield (CY) = annual coupon payment / current market price

Solved 1) A 10-year bond with a 9% annual coupon has a yield - Chegg Question: 1) A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. The bond is selling at a premium to par value. b. The bond is selling at a discount. c. The bond is selling below its par value. d. The bond will earn a rate of return greater than 8%. This problem has been solved!

A 10 year bond with a 9 annual coupon has a yield to A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. If the yield to maturity remains constant, the bond's price one year from now will be higher than its current price. b. The bond is selling below its par value.c. The bond is selling at a discount. d.

[Solved] A 10-year $1,000 par value bond has a 9% | SolutionInn A 10-year $1,000 par value bond has a 9% semiannual. A 10-year $1,000 par value bond has a 9% semiannual coupon and a nominal yield to maturity of 8.8%. What is the price of the bond? Coupon. A coupon or coupon payment is the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from issue date until maturity.

What is the yield to maturity for a 3 year bond with a 10% ... Jun 20, 2022 · The yield of maturity will be 10% itself , Option C is the right answer. The missing option are. What is the yield to maturity for a 3 year bond with a 10% annual coupon if the bond is trading at par? A) 11.00%. B) 9.00%. C) 10.00%. D) 9.75%. What is the meaning of Trading at Par ? At par means the bond or stock is trading at its face value ,

Solved A 10-year bond with a 9% annual coupon has a yield to - Chegg Question: A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. the bond is selling below its par value b. the bond is selling at a discount c. the bond will earn a rate of return greater than 8% d. the bond is selling at a premium to par value This problem has been solved!

How to Calculate the Price of Coupon Bond? - WallStreetMojo Therefore, calculation of the Coupon Bond will be as follows, So it will be - = $838.79 Therefore, each bond will be priced at $838.79 and said to be traded at a discount ( bond price lower than par value) because the coupon rate is lower than the YTM. XYZ Ltd will be able to raise $4,193,950 (= 5,000 * $838.79). Example #2

Solved A 10-year bond with a 9% annual coupon has a yield to | Chegg.com A 10-year bond with a 9% annual coupon has a yield to maturity of 8% which statement about this bond is correct? O a. The bond is selling at a premium to its par value. O b. The bond is selling at a discount to its par value. O c. The bond is selling below its par value O d. The bond is price to sell at its par value. Save & Continue

Answered: A 10-year bond with a 9% annual coupon… | bartleby Transcribed Image Text: A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? * If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. The bond is selling below its par value. The bond's current yield is greater than 9%.

Solved A 10-year bond with a 9% annual coupon has a yield to - Chegg A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. b. If the yield to maturity remains constant, the bond's price one year from now will be higher than its

Answered: A 10-year, 12 percent semiannual coupon… | bartleby A 10-year, 12 percent semiannual coupon bond, with a par value of $1,000 sells for $1,100. What is the bond s yield to maturity?

a-10-year-bond-with-a-9-percent-annual-coupon-has-a-yield A 10-year bond with a 9 percent annual coupon has a yield to maturity of 8 percent. Which of the following statements is most correct? a. The bond is selling at a discount. b. The bond's current yield is greater than 9 percent. c. If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. d.

A 10-year bond with a 9% annual coupon has a yield to maturity of 8% ... answered A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. The bond is selling below its par value. b. The bond is selling at a discount. c. If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. d.

A 10 year bond with a 9 annual coupon has a yield to - Course Hero A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? * 1/1 a. If the yield to maturity remains constant, the bond's price one year from now will be higher than its current price. b. The bond is selling below its par value. c. The bond is selling at a discount. d.

What Is Coupon Rate and How Do You Calculate It? - SmartAsset To calculate the bond coupon rate we add the total annual payments and then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate.

A 10-year bond paying 8% annual coupons pays $1000 at maturity ... - Quora Answer (1 of 3): We can use the formula for present value of annuity to calculate this. The formula is: Here P is the amount annually paid i.e. 80 (assuming nominal value of $1000), r is the required rate of return i.e. 7%(not coupon rate of 8%) and n is 10 years. Also, the above formula consid...

Bond Pricing Formula | How to Calculate Bond Price? | Examples Since the coupon rate is higher than the YTM, the bond price is higher than the face value, and as such, the bond is said to be traded at a premium. Example #3. Let us take the example of a zero-coupon bond. Let us assume a company QPR Ltd has issued a zero-coupon bond with having a face value of $100,000 and maturing in 4 years.

Bond Valuation Calculator | Calculate Bond Valuation Bond Valuation Definition. Our free online Bond Valuation Calculator makes it easy to calculate the market value of a bond. To use our free Bond Valuation Calculator just enter in the bond face value, months until the bonds maturity date, the bond coupon rate percentage, the current market rate percentage (discount rate), and then press the calculate button.

Bond: Financial Meaning With Examples and How They Are Priced Jul 01, 2022 · Bond: A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or ...

![Solved] A 20-year, $1,000 par value bond has a 9% semi-annual ...](https://www.cliffsnotes.com/tutors-problems/assets/img/attachments/20153973.jpg)

Post a Comment for "40 a 10 year bond with a 9 annual coupon"