45 difference between yield to maturity and coupon rate

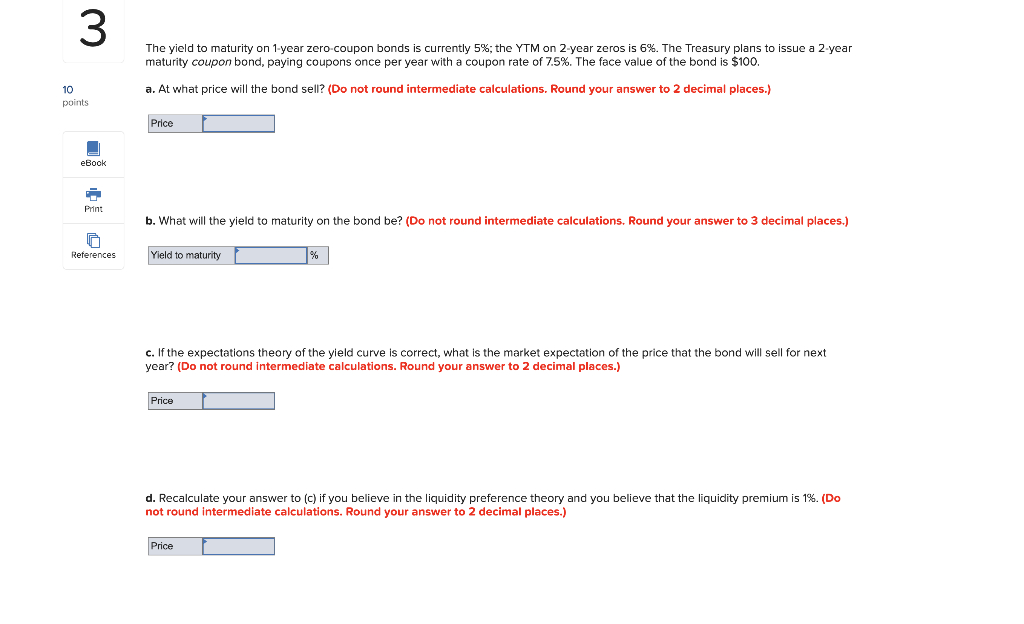

› the-difference-betweenThe Difference Between Coupon and Yield to Maturity - The Balance Mar 04, 2021 · Coupon vs. Yield to Maturity . A bond has a variety of features when it's first issued, including the size of the issue, the maturity date, and the initial coupon.For example, the U.S. Treasury might issue a 30-year bond in 2019 that's due in 2049 with a coupon of 2%. en.wikipedia.org › wiki › Yield_curveYield curve - Wikipedia The slope of the yield curve is one of the most powerful predictors of future economic growth, inflation, and recessions. One measure of the yield curve slope (i.e. the difference between 10-year Treasury bond rate and the 3-month Treasury bond rate) is included in the Financial Stress Index published by the St. Louis Fed. A di

› fixed-income-essentials-4689775Fixed Income - Investopedia Dec 05, 2021 · Matilda Bond: A bond denominated in the Australian dollar and issued on the Australian market by a foreign entity that seeks to raise capital from Australian investors. A Matilda Bond may attract ...

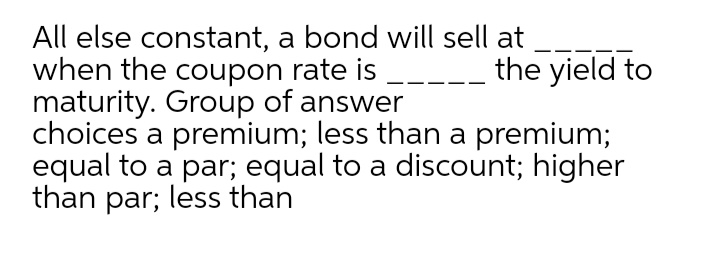

Difference between yield to maturity and coupon rate

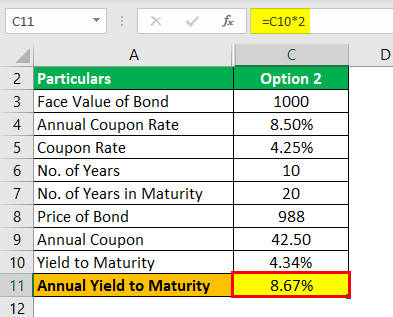

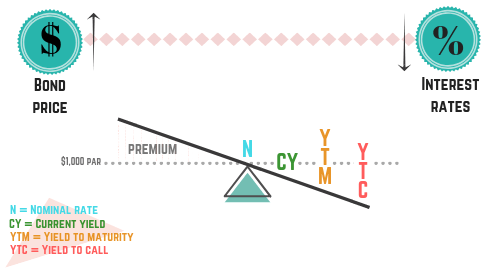

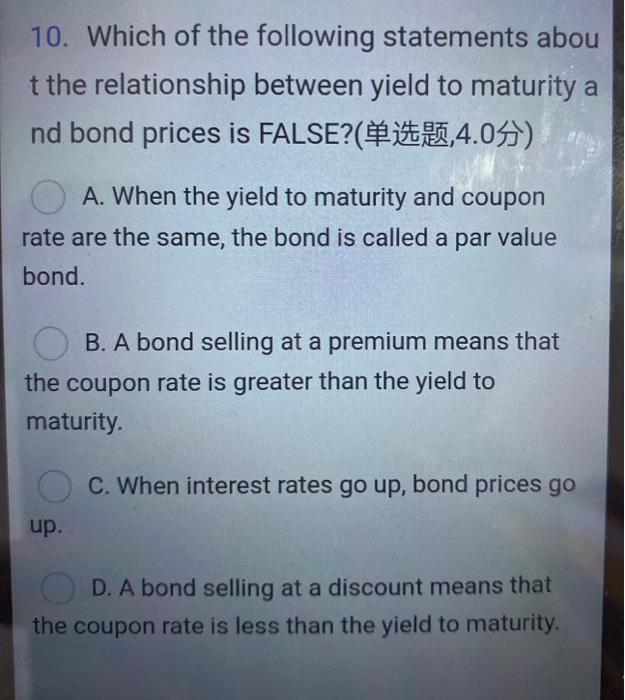

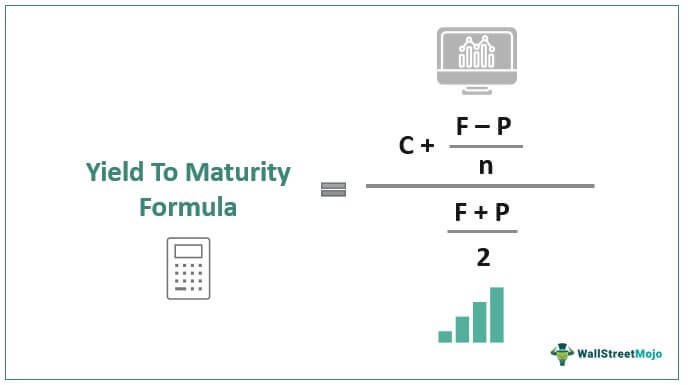

› ask › answersBond Yield Rate vs. Coupon Rate: What's the Difference? Mar 22, 2022 · Coupon Pass: The purchase of treasury notes or bonds from dealers, by the Federal Reserve. › ask › answersYield to Maturity vs. Yield to Call: The Difference Sep 16, 2022 · Yield to Maturity . A bond's yield is the total return that the buyer will receive between the time the bond is purchased and the date the bond reaches its maturity. For example, a city might ... › ask › answersYield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A ...

Difference between yield to maturity and coupon rate. › ask › answersWhen is a bond's coupon rate and yield to maturity the same? Jan 13, 2022 · The entire calculation takes into account the coupon rate, current price of the bond, difference between price and face value, and time until maturity. Along with the spot rate, yield to maturity ... › ask › answersYield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A ... › ask › answersYield to Maturity vs. Yield to Call: The Difference Sep 16, 2022 · Yield to Maturity . A bond's yield is the total return that the buyer will receive between the time the bond is purchased and the date the bond reaches its maturity. For example, a city might ... › ask › answersBond Yield Rate vs. Coupon Rate: What's the Difference? Mar 22, 2022 · Coupon Pass: The purchase of treasury notes or bonds from dealers, by the Federal Reserve.

:max_bytes(150000):strip_icc()/female-executive-talking-to-colleagues-117455512-5750d4d75f9b5892e8b3d3af.jpg)

:max_bytes(150000):strip_icc()/terms_b_bond-yield_FINAL-3ab7b1c73e8b487a9e860f0a5ca6dd6b.jpg)

Post a Comment for "45 difference between yield to maturity and coupon rate"