43 zero coupon bond face value

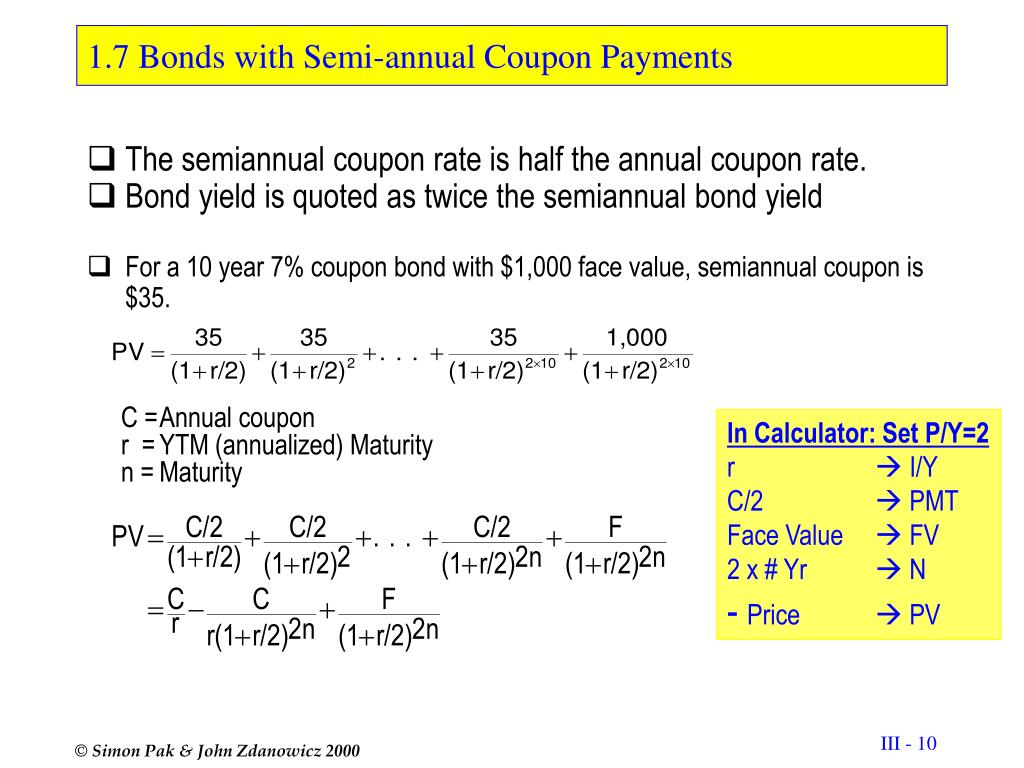

Bond Price Calculator | Formula | Chart To calculate the coupon per period you will need two inputs, namely the coupon rate and frequency. It can be calculated using the following formula: coupon per period = face value * coupon rate / frequency. As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Zero-Coupon Bond Definition - Investopedia A zero-coupon bond is a debt security instrument that does not pay interest. Zero-coupon bonds trade at deep discounts, offering full face value (par) profits at maturity. The difference between...

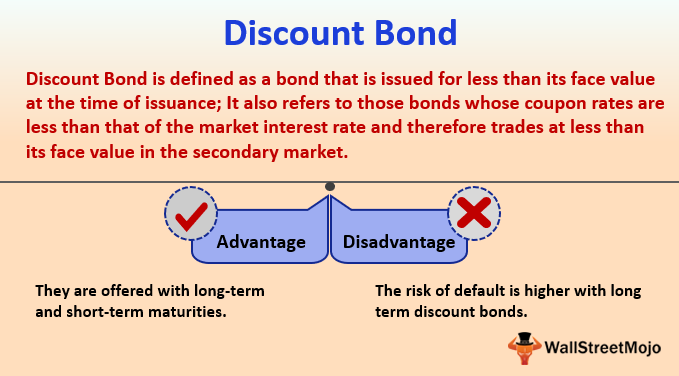

Zero coupon bond definition — AccountingTools Zero coupon bond definition January 15, 2022 What is a Zero Coupon Bond? A zero coupon bond is a bond with no stated interest rate. Investors purchase these bonds at a considerable discount to their face value in order to earn an effective interest rate. An example of a zero coupon bond is a U.S. savings bond. Disadvantages of Zero Coupon Bonds

Zero coupon bond face value

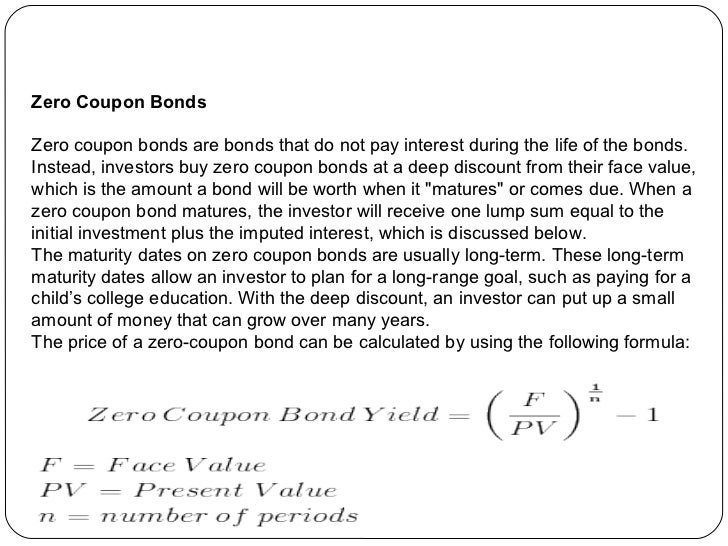

RBI orders five banks to list zero coupon bonds at "fair value" A zero-coupon bond is not an interest bearing security. Unlike other bonds, it does not pay interest regularly. These are issued at deep discounts to their face value and are redeemed at face value on the maturity date. For example, a Rs 100 face value bond maturing in 10 years could be issued at Rs. 55. Explaining Zero-Coupon Bonds - Wolfline Capital The difference between a regular bond and a zero-coupon bond is the payment of interest, known as coupon payments. A regular bond pays interest to investors by way of coupons payments, whereas a zero-coupon bond does not make such interest payments, although zero-coupon bondholders receive the face value of the bond at the time it reaches maturity. How to Calculate Yield to Maturity of a Zero-Coupon Bond The formula for calculating the yield to maturity on a zero-coupon bond is: Yield To Maturity= (Face Value/Current Bond Price)^ (1/Years To Maturity)−1 Zero-Coupon Bond YTM Example Consider a...

Zero coupon bond face value. Coupon Bond - Guide, Examples, How Coupon Bonds Work Let's imagine that Apple Inc. issued a new four-year bond with a face value of $100 and an annual coupon rate of 5% of the bond's face value. In this case, Apple will pay $5 in annual interest to investors for every bond purchased. After four years, on the bond's maturity date, Apple will make its last coupon payment. Are Bonds Taxable? 2022 Rates, Types of Bonds, Tax-Minimizing ... - Insider For example, you might pay $3,000 to buy a 20-year zero-coupon bond with a face value of $10,000. After 20 years, the issuer pays you $10,000. The difference between the amount you pay for a zero ... What Is the Coupon Rate of a Bond? - The Balance ABC bond's coupon rate was 3%, based on a par value of $1,000 for the bond. This translates to $30 of interest paid each year. Let's say Investor 1 purchases the bond for $900 in the secondary market but still receives the same $30 in interest. This translates to a current yield of 3.33%. Zero Coupon Bond: Definition, Formula & Example - Study.com The basic method for calculating a zero coupon bond's price is a simplification of the present value (PV) formula. The formula is price = M / (1 + i )^ n where: M = maturity value or face value i =...

Zero Coupon Bond | Definition, Formula & Examples - Study.com Based on the calculated present value of the coupon rate and the present value of the face value, the total price of the coupon bond is $47.84 + $942.60 = $990.44 Zero-Coupon Bond vs Coupon Bond: Zero Coupon Bond - Explained - The Business Professor, LLC Unlike the regular, coupon-paying bonds, a zero-coupon bond has an imputed interest rate (rather than an established interest rate). To illustrate, if a bond with a face value of $1,000 matures in 20 years with a 5.5% annual yield, can be purchased at $3,378. This represents $1,000 in value in 20 years if the money compounds annually for 20 years. Zero Coupon Bond Calculator - Calculator Academy Zero Coupon Bond Formula. The following formula is used to calculate the value of a zero-coupon bond. ZCBV = F / (1+r)^t. where ZCBV is the zero-coupon bond value. F is the face value of the bond. r is the yield/rate. t is the time to maturity. Screen Shot 2022-06-23 at 11.13.52 AM.png - 5. Suppose you... Suppose you bought a five-year zero-coupon Treasury bond for $800 per $1000 face value. Assuming yields to 1/ 1. Study Resources ... Suppose you bought a five-year zero-coupon Treasury bond for $800 per $1000 face value. Assuming yields. Screen Shot 2022-06-23 at 11.13.52 AM.png - 5. ... Mathematical finance, Zero coupon bond, Basic financial ...

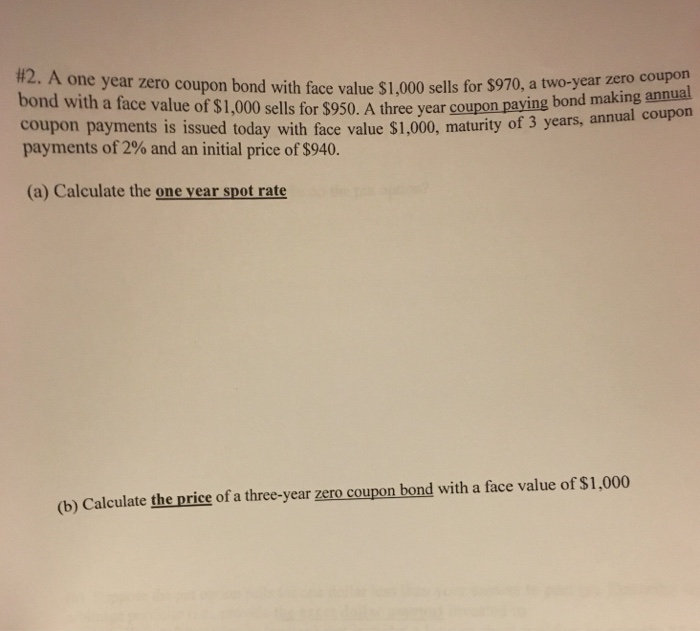

Basics Of Bonds - Maturity, Coupons And Yield As the name suggests, these are bonds that pay no coupon or interest. Instead of getting an interest payment, you buy the bond at a discount from the face value of the bond, and you are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond with a face value of $10,000. Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding What is a Zero Coupon Bond? - ICICIdirect The formula used to calculate the price of zero-coupon bonds is: Price = Face Value/ (1+r)^n Where r is the annual return, and n is the number of years until maturity. Why invest in a Zero Coupon Bond 1. Returns are predictable The most significant advantage of a zero-coupon bond is that the returns that you receive on them are known in advance. Solved Yields: On April 1, 2022, the prices of 1-year, | Chegg.com Finance questions and answers. Yields: On April 1, 2022, the prices of 1-year, 2-year, and 3-year zero coupon US Treasury bonds with face value 100 were, respectively, 98.2318, 95.1814, and 92.5887 (a) Calculate the yields, in percent terms, of the three bonds. (b) Using the expectations theory of the yield curve, find the expected one-year in ...

What Is a Zero-Coupon Bond? | The Motley Fool Price of Zero-Coupon Bond = Face Value / (1+ interest rate/2) ^ time to maturity*2 Price of Zero-Coupon Bond = $10,000 / (1.025) ^ 20 = $6,102.77 With semiannual compounding, we see the bond...

How do I Calculate Zero Coupon Bond Yield? (with picture) The zero coupon bond yield is easier to calculate because there are fewer components in the present value equation. It is given by Price = (Face value)/ (1 + y) n, where n is the number of periods before the bond matures. This means that you can solve the equation directly instead of using guess and check. The yield is thus given by y = (Face ...

Spot Rates and Forward Rates - CFA, FRM, and Actuarial Exams Study Notes If the spot rate curve of a coupon-paying bond is flat, the YTM will be the same as the spot rate. Also, note that the YTM of a zero-coupon bond is equal to the spot rate. Example: Spot Rates and Yield to Maturity. ABC Ltd. has issued a bond with a face value of $500, which carries an annual coupon of 10% and matures in 4 years.

What Is a Zero-Coupon Bond? - Meity.Org A zero-coupon bond, also known as an accrual bond, is a debt security that does not pay interest but instead trades at a deep discount, rendering a profit at maturity, when the bond is redeemed for its full face value. KEY TAKEWAYS. A zero-coupon bond is a debt security instrument that does not pay interest. Zero-coupon bonds trade at deep ...

Zero Coupon Bond Funds: What Are They? - The Balance A zero coupon bond is a bond that doesn't offer interest payments but sells at a discount—a price lower than its face value. 1 The bondholder doesn't get paid while they own the bond, but when the bond matures, they will be repaid the full face value. Zero coupon bond funds are funds that hold these types of bonds.

What is Bond Face Value? | Bond Investing | Investment U It's also worth noting zero-coupon bonds here. Since these bonds don't pay interest, they almost always trade below par value in secondary markets. An Example of Bond Value. The Type of Bond Matters. The face value of a bond depends on the type of bond. Most AAA bonds—high quality corporate bonds— come in denominations of $1,000. Other ...

What Is a Zero-Coupon Bond? Definition, Characteristics & Example Typically, the following formula is used to calculate the sale price of a zero-coupon bond based on its face value and maturity date. Zero-Coupon Bond Price Formula Sale Price = FV / (1 + IR) N...

Price of a Zero coupon bond - Calculator - Finance pointers Price of a Zero coupon bond - Calculator. August 20, 2021 | 0 Comment | 9:15 pm. The Price of a zero coupon bond is calculated using the following formula : = FV / ( 1 + r ) n. Where. P = Price of a zero coupon bond ; FV = Face value / Maturity value of the zero coupon bond ; r = Discount rate ; n = Term to maturity ; In the calculator below ...

Post a Comment for "43 zero coupon bond face value"