45 coupon rate bond calculator

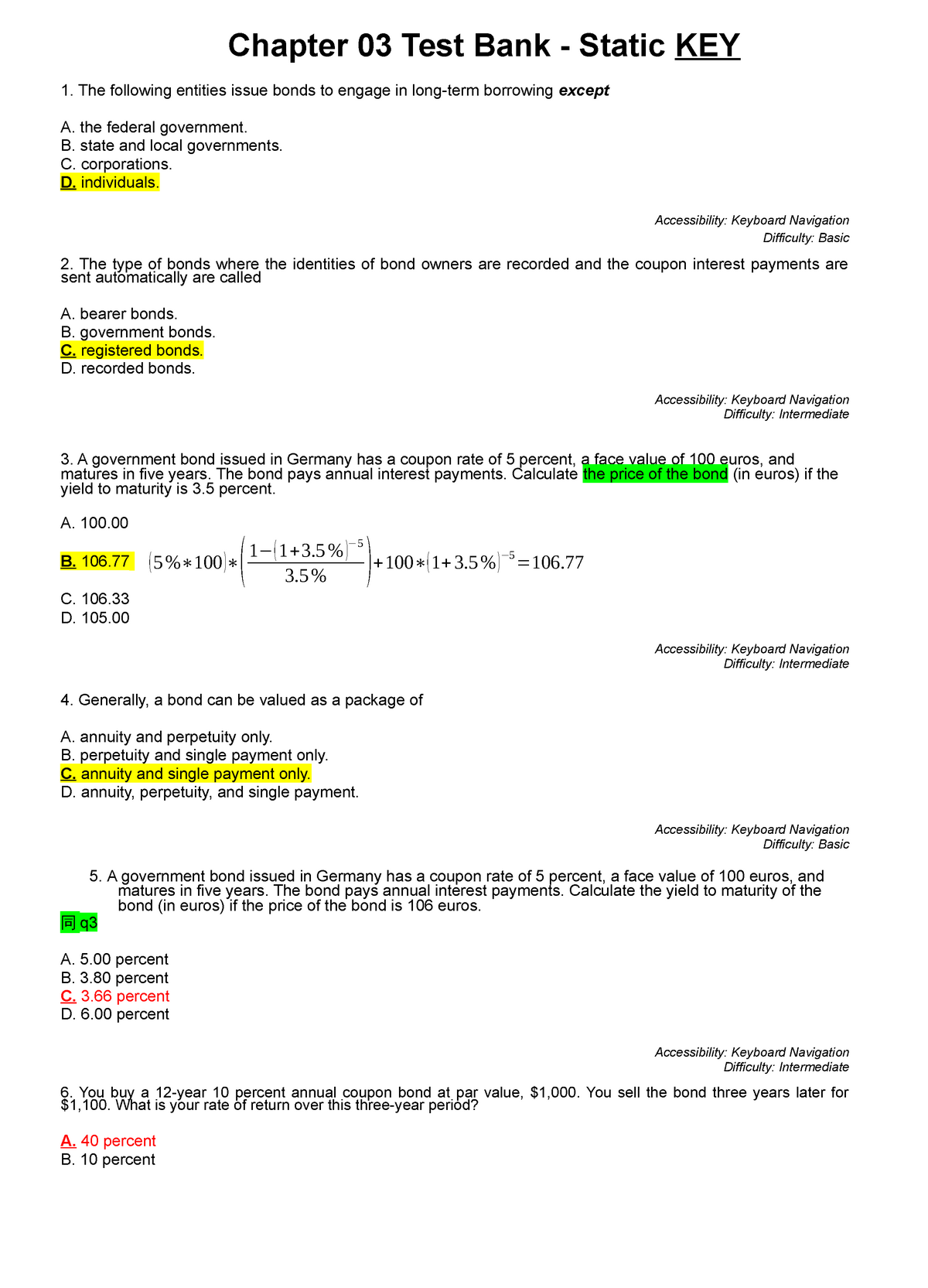

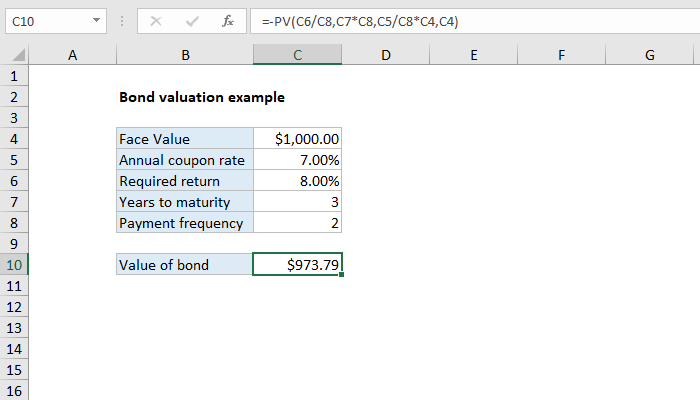

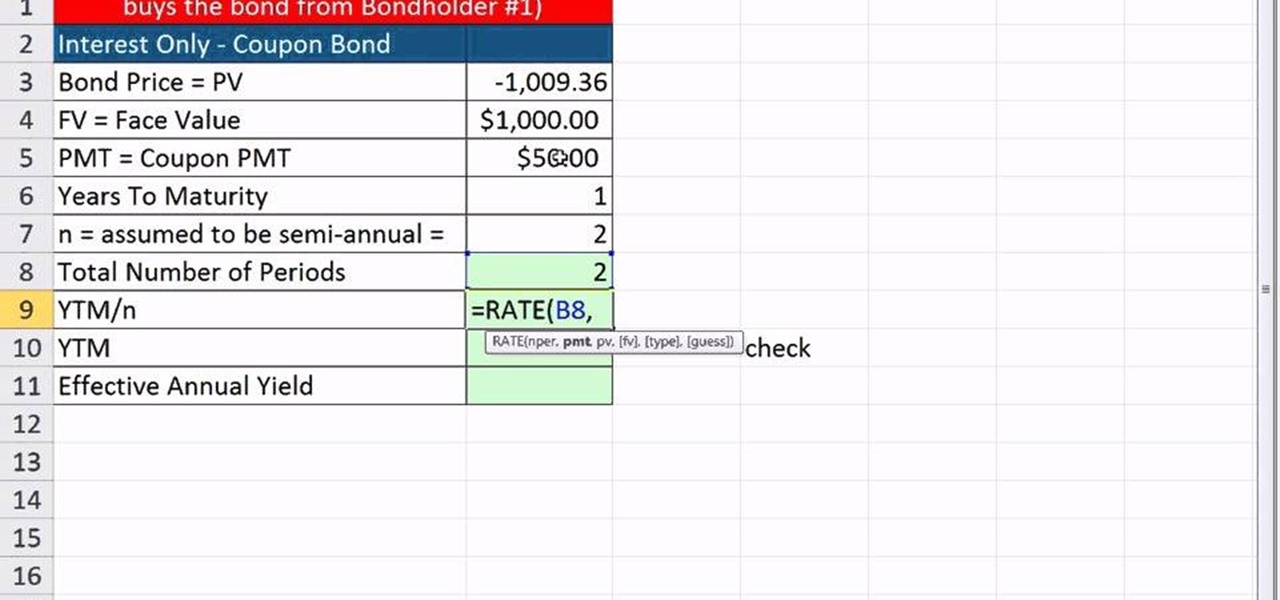

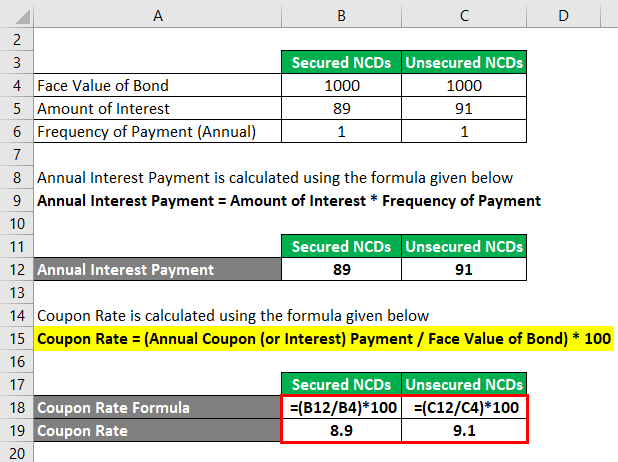

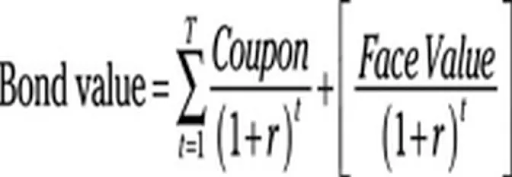

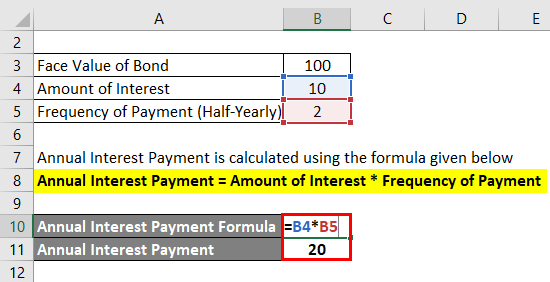

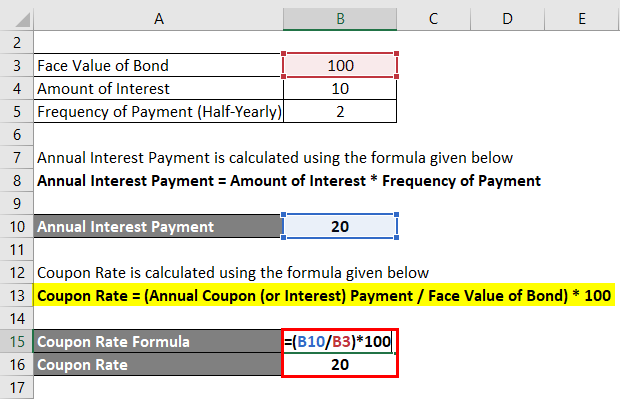

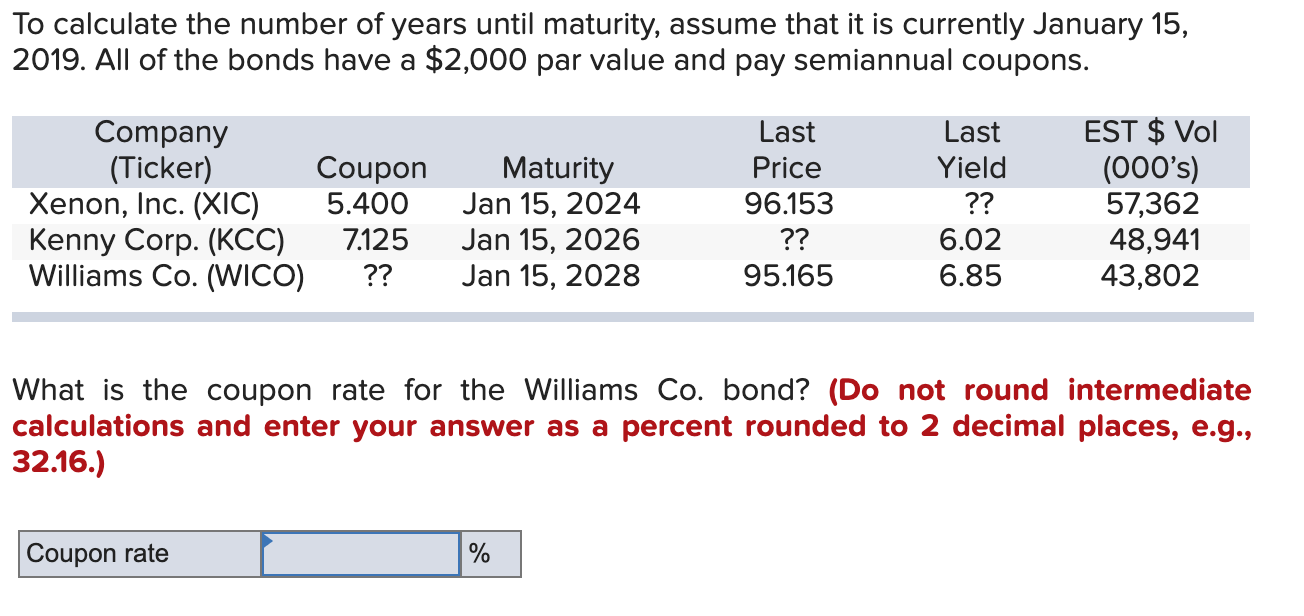

› terms › yYield to Maturity (YTM): What It Is, Why It Matters, Formula May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ... smartasset.com › investing › bond-coupon-rateWhat Is Coupon Rate and How Do You Calculate It? - SmartAsset Aug 26, 2022 · To calculate the bond coupon rate we add the total annual payments and then divide that by the bond’s par value: ($50 + $50) = $100; The bond’s coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond’s interest rate.

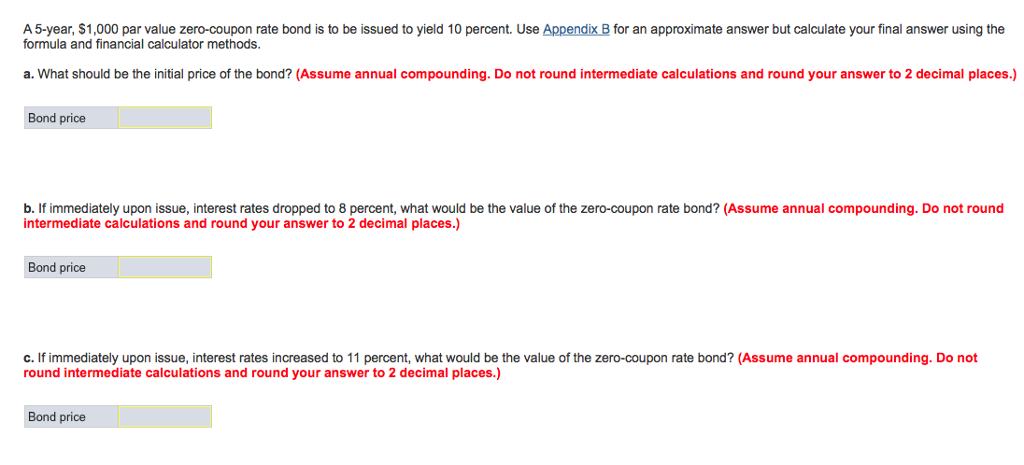

dqydj.com › zero-coupon-bond-calculatorZero Coupon Bond Calculator – What is the Market Price ... P: The par or face value of the zero coupon bond; r: The interest rate of the bond; t: The time to maturity of the bond; Zero Coupon Bond Pricing Example. Let's walk through an example zero coupon bond pricing calculation for the default inputs in the tool. Face value: $1000; Interest Rate: 10%; Time to Maturity: 10 Years, 0 Months ...

Coupon rate bond calculator

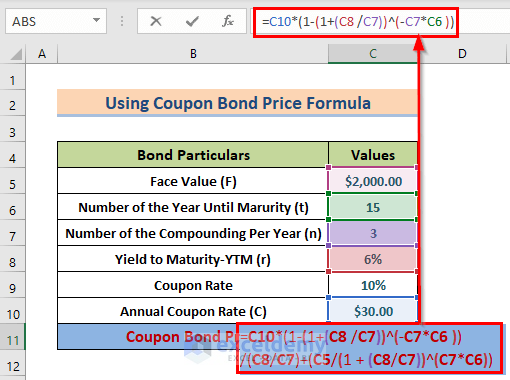

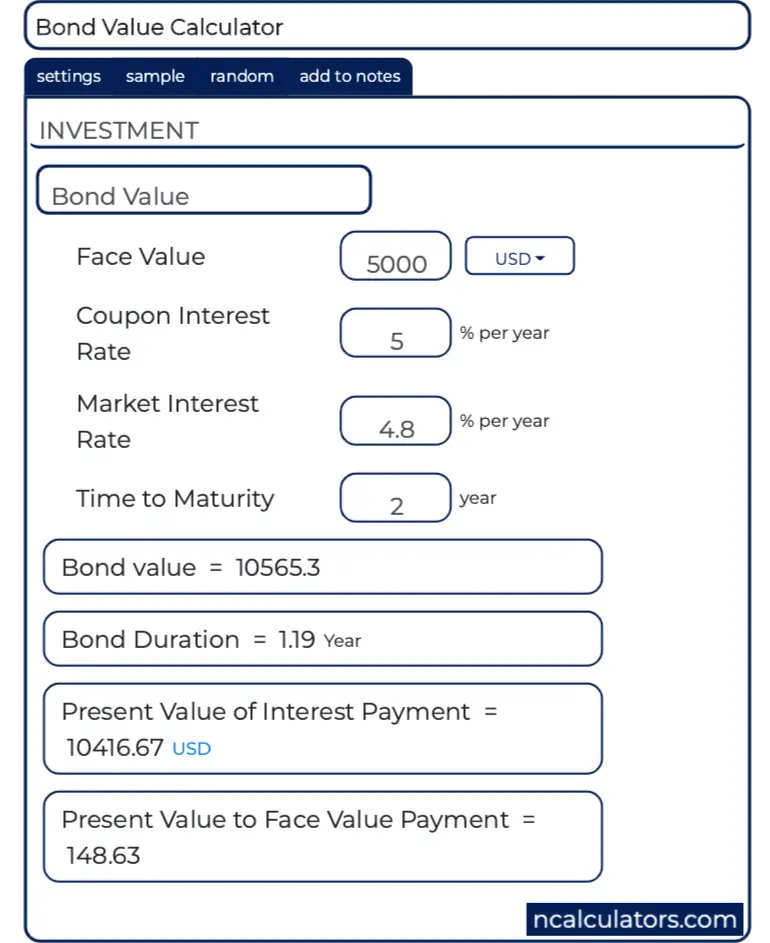

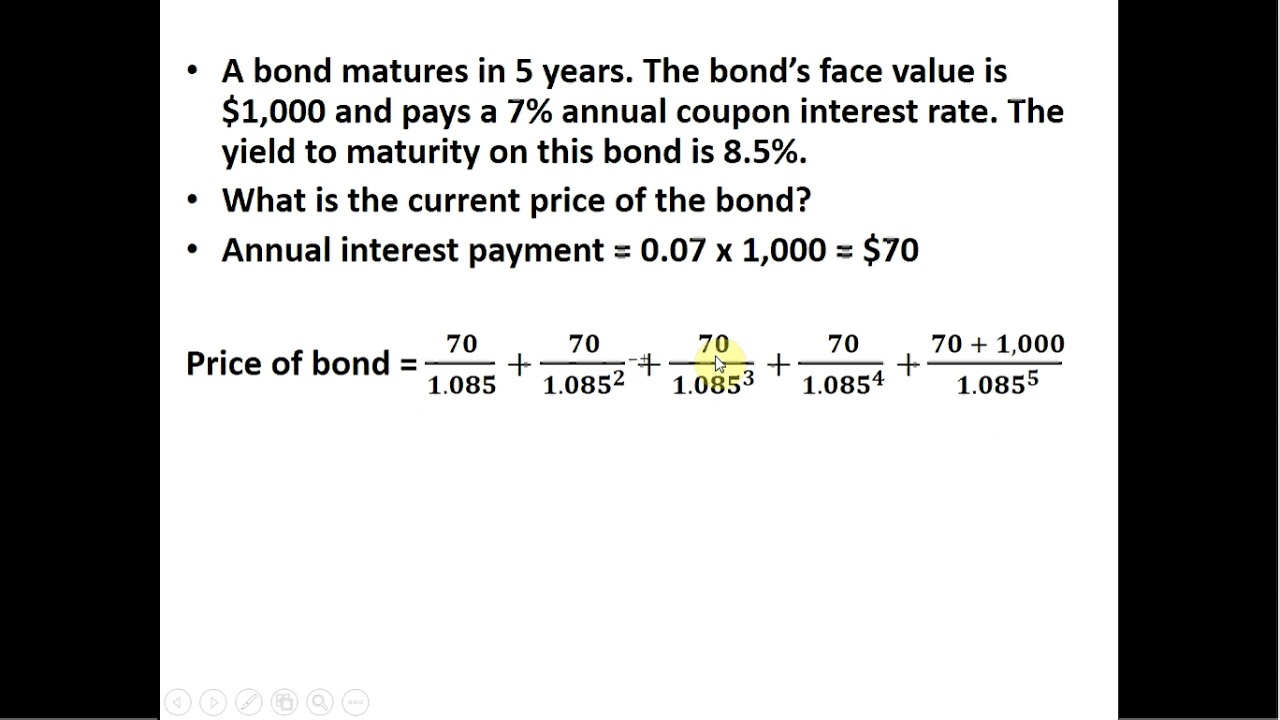

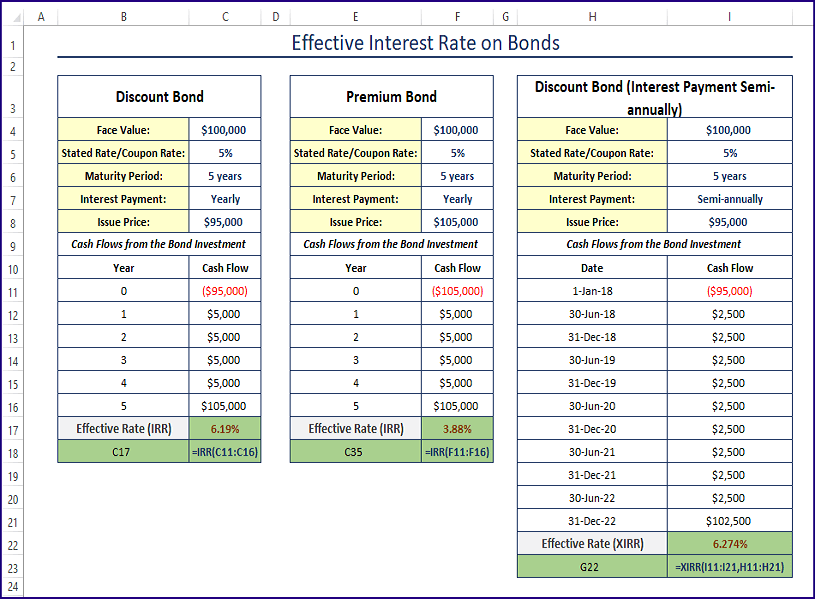

dqydj.com › bond-pricing-calculatorBond Price Calculator – Present Value of Future Cashflows - DQYDJ The bond pricing calculator shows the price of a bond from coupon rate, market rate, and present value of payouts. Plus dirty & clean bond price formulas. › calcs › bondsBond Yield to Maturity Calculator for Comparing Bonds Let's say you buy a 10 year $1000 bond with a 5% coupon. You hold that bond for the next few years collecting your $50 of annual interest. During that time, interest rates fall, and a comparable 10 year $1000 bond now carries a 4% coupon. Your original bond is now a much more valuable commodity, and it can be sold at a premium on the open market. › what-is-the-coupon-rateWhat Is the Coupon Rate of a Bond? - The Balance Nov 18, 2021 · The annual interest paid divided by bond par value equals the coupon rate. As an example, let’s say the XYZ corporation issues a 20-year bond with a par value of $1,000 and a 3% coupon rate. Bondholders will receive $30 in interest payments each year, generally paid on a semiannual basis.

Coupon rate bond calculator. › finance › coupon-rateCoupon Rate Calculator | Bond Coupon As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate; The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment ... › what-is-the-coupon-rateWhat Is the Coupon Rate of a Bond? - The Balance Nov 18, 2021 · The annual interest paid divided by bond par value equals the coupon rate. As an example, let’s say the XYZ corporation issues a 20-year bond with a par value of $1,000 and a 3% coupon rate. Bondholders will receive $30 in interest payments each year, generally paid on a semiannual basis. › calcs › bondsBond Yield to Maturity Calculator for Comparing Bonds Let's say you buy a 10 year $1000 bond with a 5% coupon. You hold that bond for the next few years collecting your $50 of annual interest. During that time, interest rates fall, and a comparable 10 year $1000 bond now carries a 4% coupon. Your original bond is now a much more valuable commodity, and it can be sold at a premium on the open market. dqydj.com › bond-pricing-calculatorBond Price Calculator – Present Value of Future Cashflows - DQYDJ The bond pricing calculator shows the price of a bond from coupon rate, market rate, and present value of payouts. Plus dirty & clean bond price formulas.

Post a Comment for "45 coupon rate bond calculator"