41 value of zero coupon bond

14.3 Accounting for Zero-Coupon Bonds - Financial Accounting That is the charge paid for the use of the money that was borrowed. The price reduction below face value can be so significant that zero-coupon bonds are sometimes referred to as deep discount bonds. To illustrate, assume that on January 1, Year One, a company offers a $20,000 two-year zero-coupon bond to the public. A single payment of $20,000 ... Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years. Divide the $1,000 by $500 gives us 2. Raise 2 to the 1/30th power and you get 1.02329. Subtract 1, and you have 0.02329, which is 2.3239%. Advantages of Zero-coupon Bonds Most bonds typically pay out a coupon every six months.

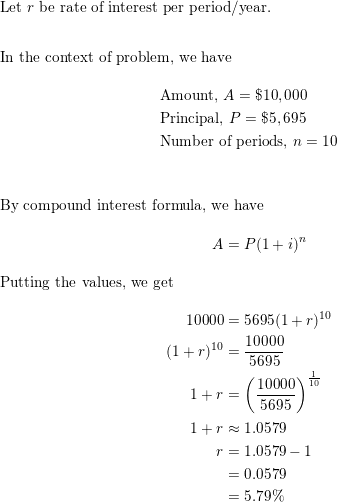

Zero Coupon Bond Value Formula - Crunch Numbers Let's assume an investor wants to buy a zero-coupon bond and wants to evaluate what YTM of this bond would be. The face value of the bond is $10,000. The price of the bond is $9,100. There are 2 years until maturity. YTM = \sqrt [2] { \frac {10,000} {9,100} } - 1 = 4.83\% Y T M = 2 9,10010,000 −1 =4.83% YTM of this bond is 4.83%.

Value of zero coupon bond

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia If a zero-coupon bond is purchased for $1,000 and given away as a gift, the gift giver will have used only $1,000 of their yearly gift tax exclusion. The recipient, on the other hand, will receive... What Is a Zero-Coupon Bond? - The Motley Fool Price of Zero-Coupon Bond = $10,000 / (1.05) ^ 10 = $6,139.11 This means that given the above variables, you'd be able to purchase a bond for $6,139.11, wait 10 years, and redeem it for $10,000.... For zero coupon bonds? Explained by FAQ Blog What is a zero-coupon bond Mcq? A zero-coupon bond is a debt security instrument that does not pay interest. Zero-coupon bonds trade at deep discounts, offering full face value (par) profits at maturity. The difference between the purchase price of a zero-coupon bond and the par value, indicates the investor's return.

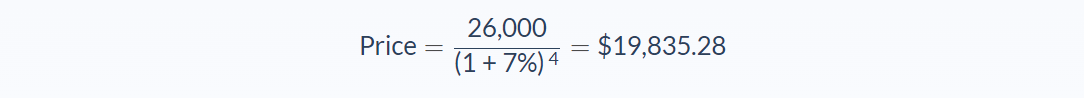

Value of zero coupon bond. Zero-Coupon Bond Value | Formula, Example, Analysis, Calculator The value of a zero-coupon bond is determined by its face value, maturity date, and the prevailing interest rate. The formula to calculate the value of a zero-coupon bond is Price = M / (1+r)n where: M = maturity value or face value of the bond r = rate of interest required n = number of years to maturity 3. Zero-Coupon Bond Definition - Investopedia The price of a zero-coupon bond can be calculated with the following equation: Zero-coupon bond price = Maturity value ÷ (1 + required interest rate)^number years to maturity How Does the IRS Tax... What Is a Zero-Coupon Bond? Definition, Characteristics & Example Zero-Coupon Bond Pricing Example. If an investor wanted to make 5% imputed interest on a zero-coupon bond with a face value of $15,000 that matures in four years, how much would they be willing to ... Zero Coupon Bond Value - Formula (with Calculator) - finance formulas A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

Zero-Coupon Bond: Formula and Calculator - Wall Street Prep To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Formula Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1 Interest Rate Risks and "Phantom Income" Taxes How Do Zero Coupon Bonds Work? - SmartAsset What Is a Zero Coupon Bond? A zero coupon bond is a type of bond that trades at a deep discount and doesn't pay interest. While some bonds start out as zero coupon bonds, others are can get transformed into them if a financial institution removes their coupons. When the bond reaches maturity, you'll get the par value (or face value) of the ... What are Zero-Coupon Bonds? (Definition, Formula, Example, Advantages ... Mr. Tee is looking to purchase a zero-coupon bond with a face value of $50 and 5 years till maturity. The interest rate on the bond is 2% and will be compounded annually. In the scenario above, the face value of the bond is $50. However, to calculate the price that needs to be paid for the bond today, the following formula is used: Solved What is the intrinsic value of a zero-coupon bond, - Chegg What is the intrinsic value of a zero-coupon bond, with a $1,000 face value, that matures in 10 years if an investor's required rate of return for the bond is 3.7 % ? ( Assume annual discounting.) O a. $ 912.04 b. $ 695.36 Oc. $ 667.55 O d. $ 670.55 Oe. $ 660.60 Question 30 Not yet arm Markand out o Tflag questi Finish attempt.

Zero Coupon Bond | Investor.gov Zero Coupon Bond Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Zero-Coupon Bond (Also known as Pure Discount Bond or Accrual Bond) refers to those bonds which are issued at a discount to its par value and makes no ... Calculate the Value of a Zero-coupon Bond - Finance Train The bond discount rate is 12%. What is the appropriate price for this bond? Since there are no interim coupon payments, the value of the bond will simply be the present value of single payment at maturity. R Programming - Data Science for Finance Bundle. (6 eBooks) - 25% OFF GET THIS NOW. Zero Coupon Bonds - Financial Edge What is the present value of a zero coupon bond with a face value of 1000 maturing in 5 years? The current interest rate is 3%. Using the formula mentioned above gives 862.6 as the bond's present value. Calculating yield-to-maturity or expected returns.

What Is a Zero-Coupon Bond? Definition, Advantages, Risks As of November 2020, the current yield-to-maturity rate on the PIMCO 25+ year zero-coupon bond ETF, a managed fund consisting of a variety of long-term zeros, is 1.54%. The current yield on a...

Zero Coupon Bond Calculator - Nerd Counter For instance, the maturity period of a zero-coupon bond is 10-years, its par value is $1000, the interest rate is 5.00%. When we are calculating the bond price in Excel, suppose we use the B column of the excel sheet for entering the values where B2 is the face value, B3 is the maturity time period, B4 is the interest rate.

Zero Coupon Bond - Explained - The Business Professor, LLC Below is the formula for calculating the present value of a zero coupon bond: Price = M / (1 + r)^n where M = the date of maturity r = Interest Rate n = # of Years until Maturity If an investor wishes to make a 4% return on a bond with $10,000 par value due to mature in 2 years, he will be willing to pay: $10,000 / (1 + 0.04)^2 = $9,245.

Zero Coupon Bond: Formula & Examples - Study.com The zero-coupon bond definition is a financial instrument that does not pay interest or payments at regular frequencies (e.g. 5% of face value yearly until maturity). Rather, zero-coupon bonds ...

The One-Minute Guide to Zero Coupon Bonds | FINRA.org Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond with a face value of $10,000. After 20 years, the issuer of the bond pays you $10,000.

How to Buy Zero Coupon Bonds | Finance - Zacks The less you pay for a zero coupon bond, the higher the yield. A bond with a face value of $1,000 purchased for $600 will yield $400 at maturity. Zero coupon bonds are issued by the Treasury...

Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding

Zero Coupon Bond Calculator - What is the Market Value? So a 10 year zero coupon bond paying 10% interest with a $1000 face value would cost you $385.54 today. In the opposite direction, you can compute the yield to maturity of a zero coupon bond with a regular YTM calculator. Other Financial Basics Calculators Zero coupon bonds are yet another interesting security in the fixed income world.

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816)

Zero Coupon Bonds Explained (With Examples) - Fervent The value of a zero coupon bond is nothing but the Present Value of its Par Value. Zero Coupon Bond Example Valuation (Swindon Plc) Consider an example of Swindon PLC, which is issuing a zero coupon bond with a par value of £100 to be paid in one year's time. What is the price of this bond today, if the yield is 7%?

For zero coupon bonds? Explained by FAQ Blog What is a zero-coupon bond Mcq? A zero-coupon bond is a debt security instrument that does not pay interest. Zero-coupon bonds trade at deep discounts, offering full face value (par) profits at maturity. The difference between the purchase price of a zero-coupon bond and the par value, indicates the investor's return.

What Is a Zero-Coupon Bond? - The Motley Fool Price of Zero-Coupon Bond = $10,000 / (1.05) ^ 10 = $6,139.11 This means that given the above variables, you'd be able to purchase a bond for $6,139.11, wait 10 years, and redeem it for $10,000....

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia If a zero-coupon bond is purchased for $1,000 and given away as a gift, the gift giver will have used only $1,000 of their yearly gift tax exclusion. The recipient, on the other hand, will receive...

Post a Comment for "41 value of zero coupon bond"